September Stats from ARMLS

- Overall supply (excluding homes already under contract) was down 28% at the start of September 2012 compared with September 2011, and distressed supply was down 63% over the same time frame.

- New inventory declined 7.3% to 8,901 in September. This figure is 397 units (4.27%) below the average of new listings added each month since January.

- Median list price increased in September by 4.7% to land at $167,400. This metric is 27.8% higher than the same figure in 2011. The average new list price rose 16.1% to $257,600 in September. Likewise, the average list price showed a significant increase (22.2%) over the same figure a year ago.

- Both sales price metrics showed improvement in September. The median sales price rose 2.7% in September to $150,000, while the average sales price increased 2.3% to $198,800. The overall trend lines for both metrics have been upward, since reaching their respective bottoms in May 2011 for the median, and August 2011 for the average. The median sale price, which fell 56.8% from its high of $264,800 in June 2006, has risen 38.5% from its decade low of $108, 300 in May 2011. Similarly, the average sales price, which fell 56.8% from its high of $350,400 in May 2007, has increased 31.34% from it decade low of $151,368 in August 2011.

- As sales declined and total inventory rose, September’s MSI (months supply of inventory) saw a rise from 2.76 months in August to 3.53 in September. MSI below 4 months is considered a seller’s market.

- Foreclosures pending continued on their downward trend line, begun from a high of 50,568 in November 2009, to 14,584 in September. This represents a 10.9% decline from last month. Foreclosures pending have declined 37.17% over the last twelve months, and 71.6% since from the November 2009 high. Foreclosures pending in the 5,000-7,000 range is considered typical of a normal market.

- Distressed sales, composed of lender owned and short sales, fell again in September as a percent of total sales to 39.9%. In February 2011, distressed sales were at an all time high of 70.7% of total sales.

The following data is from ASU W.P. Carey School of Business with Michael Orr, Director Center of Real Estate Practice and Theory:

- Despite Bank of America taking a larger number of homes into REO inventory in August than in any previous month, 24% fewer single family homes reverted to lenders at trustee sale compared with August 2011.

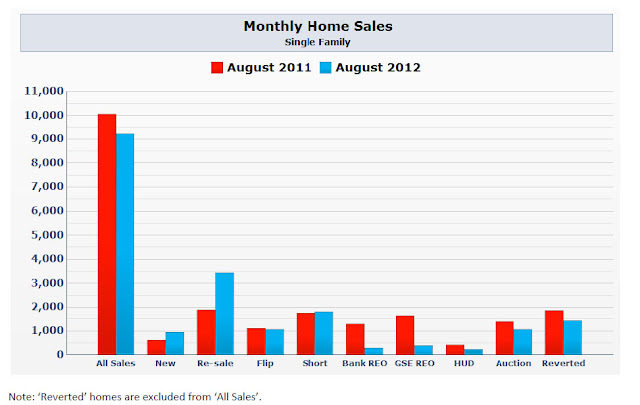

- Single family home sales increased year on year August 2011 to August 2012:

- New homes (up 55%)

- Normal re-sales (up 81%)

- Short sales and pre-foreclosures (up 5%)

- Single family home sales reduced year on year August 2011 to August 2012:

- Investor flips (down 5%)

- Bank owned homes (down 78%)

- GSE (Fannie Mae, Freddie Mac, etc.) owned homes (down 76%)

- HUD sales (down 44%)

- Third party purchases at trustee sale (down 24%)

The significant annual price increase over the last 12 months has now spread to the vast majority of Greater Phoenix. Most areas with a preponderance of more expensive homes are showing relatively modest annual gains in average price per square foot. Examples include Scottsdale (up 11%), Cave Creek (up 9%), Fountain Hills (up 11%) and Gold Canyon (up 5%). An exception is Paradise Valley which is showing a very healthy 34% increase over August 2011, and much of this is due to the complete absence of bank owned homes and foreclosures in the sales mix during August 2012.

Cash Buyers

For some considerable time, cash purchases have been running at an unusually high level due to the volume of investor activity and most sellers’ preference for cash offers over financing. In Maricopa County the percentage of properties recording an Affidavit of Value and purchased without financing rose from 37.4% in August 2011 to 38.5% in August 2012. For comparison, in June 2007 we saw 8.3% of sales being completed by cash buyers. Cash purchases now dominate at the lower end of the market but also represent almost 1 in 3 of more expensive home sales:

- Under $150,000 51% cash

- Between $150,000 and $500,000 24% cash

- $500,000 and over 32% cash

12:05 PM

12:05 PM

Swee Ng

Swee Ng

Posted in:

Posted in: